Account & Billing

Can I switch between pricing plans? (on Subbly)

Setting up Stripe

Setting up PayPal

Setting up Braintree (or PayPal through Braintree)

Setting up Auth.net

Setting up Apple Pay & Google Pay?

Setting up a specific billing time

How to connect a domain to your website?

Handling invoices

How do I set the currency for my store?

Country of trade setting

Timezone setup

Taxes

How do I export taxes on Subbly?

Can I grant access to more users to my account? (Teams app)

Can I manage the email notifications I receive?

How do I put my Subbly store and website offline?

How do I cancel my trial?

How do I cancel my account?

Preventing Customer's Cancellations

Checkout & Payments

Setting up the checkouts and customer portal on custom domain

Testing checkouts and customer portal

Setting up your branding

How do I remove Subbly branding from the checkout?

How to translate the checkout and the customer portal?

How do I add Terms & Conditions to the checkout?

Do my customers need to register to make a purchase?

Checkout & cart widget behavior

Setting up cart widget

How to enable 3DS confirmation step at checkout?

Setting up multicurrency

How to change the position of the currency symbol at the checkout?

Why are my checkouts not working?

Updating cart widget based on webpage actions

Altering cart widget functions by embedding Subbly Javascript

Website Builder

AI Website Builder

Getting Started

Welcome to Subbly's agentic builder!

Pricing, Costs, and Credits Explained

A Quick Tour of the Agentic Builder Interface

Prompting for Success: How to Talk to the Agent

How to Create Your First Prompt

Your First Project: A Step-by-Step Guide

Core Features

Setting up Your Project Settings

How to Write Effective Project Instructions

Understanding the Different AI Models Available

Understanding the Element Selector Tool

Connecting Products to the Site

How to Set up a Custom Domain

Deploying Site

Troubleshooting

My Agent isn't Behaving as Expected: Common Issues and Fixes

Optimizing for Performance and Credit Usage

How to Revert to a Previous Version

When to Start a New Chat

Contacting Support

Cancelling Your AI Website Builder

Free Resource

How-To Video Guides

Connect product checkouts to elements

Build product page with pricing plan selection

How to add upsell to the checkout funnel

Create a survey flow with an add-on

Creating a bundle page

Build one-time shop with filtering and sorting facilities

Create a newsletter form with backend capture

Integrating map and store locator

Optimizing site's SEO

Create a blog

Changing the mobile layout vs. desktop layout

Legacy Builder

Dashboard apps

Articles App

Logo maker app

Designer Tools: Overview

Fonts App

Pages App

Designer Tools: Layout

Designer Tools: Typography

SEO App

Domain App

Languages App

Designer Tools: UI Kit

Templates App

Media App

Pop-Ups App

Getting started with Dashboard and Apps

Site Settings App

Edit mode

Troubleshooting ''there is an update'' error

How to change the title for your website?

How to add a cookie consent banner to your Subbly site?

How to create a banner on the website builder?

How to submit your website to Google, Yandex, Bing or Yahoo?

How to embed Instagram feed to my website?

How to create anchor points on your website?

How to set up event tracking codes on your website?

Adding chatbot to your Subbly site

Adding visual effects to your website

Building a page from scratch with Subbly

How to add images and videos to your website?

How to add GIFs to your website?

Configuring SSL for your website

Desktop vs. Mobile versions of a website

Positioning of elements

Why my domain was labeled as HREFLANG?

How to add Trust Pilot reviews to your website?

How to build your own product layout?

Setting up Headers and Footers across pages

Managing visibility settings of Elements and Blocks

How to create a Blog?

How do customers leave a review for my products?

Getting Started with the Website Builder

Basics of the Edit Mode

How to publish the latest changes on your website?

Previewing your Subbly website

Adding and creating Blocks on your website

How to localize your website (create a multilingual website)?

Colors tool

Why do the products go to 404 page?

How to create product category filter (Website builder)

Elements

Icons element

Blank space element

Language Switcher Element

Image Slider element

Form element

Map element

Product/Products Element

Breadcrumb element

Account Element

Accordion element

Button/Product Button element

Sharing Buttons element

Logo element

Quotes element

Paragraph element

Custom HTML element

Search element

Region Switcher element

Divider element

Articles and Article Categories element

Follow Us element

Gallery element

Title element

Video element

Image element

Countdown element

Pages element

Products

Product builder wizard

What are subscriptions?

Ad-hoc subscriptions

Anchored subscriptions

Understanding cut-off dates

Incoherent subscriptions

Implications of using Anchored + Incoherent

Setting subscriptions to auto-expire

Membership subscriptions

Content feed (How to use Subbly as a paywall?)

How to set sequential subscriptions in Subbly?

Seasonal subscriptions

How does the pre-order setting work?

How to set up pre-paid subscriptions?

Setting up commitment period for your products

Setting up trial period for subscription products

How to set up shipping methods for my store?

Setting up Mondial Relay

How gifting works?

How to use gift vouchers?

How to create one-time products?

Using one time products as bundles

How do I edit my product price and billing settings?

Can I set my subscriptions to auto-cancel themselves?

How to create "Subscribe & Save" offers on Subbly?

How to unpublish a product?

Setting up funnels

Subscription add-ons

Fixed bundles

Customizable bundles

Subscribe and Save bundles

Setting up subscription products

Survey builder

Customers

How customers manage their subscription? (Customer portal)

Can I add customer's subscriptions manually?

Customer's Labels Explanation

How to switch the subscription product customer is subscribed to?

How to change renewal date for a customer?

How can I see my customers' preferences?

How to change the shipping address for a customer?

How customers change their password?

Can customers add products to their subscription?

How to process a refund for the customer?

How to reactivate customer's subscription

How does skipping/pausing work?

Handling customer email notifications through Subbly (Templated emails)

Account credit balance

How do I export my customer data from Subbly?

Why my customer wasn't charged?

How to cancel customer's subscription?

Event Logs

AI Author Bot (powered by AI)

Orders

Order Labels Explained

Handling Orders

How to filter orders?

Importing Orders

Can I create a test order?

How to create adhoc orders/charges?

How to add a tracking number for customer's order?

Why am I not seeing my orders?

Why my orders don't appear in my Shipstation admin?

Growth & Retention

Customer retention

How dunning tool works on Subbly?

Cancellation Offers (Cancellation Flow)

Cancellation Analytics

Churn Insights

Payment Failure Email

Upcoming Renewal Email

Predictive churn (powered by AI)

Growth tools

Automations FAQ

Automations recipes (use cases)

Coupons

Inventory Management

Handling out of stock

Using cart abandonment tool

Setting up lead forms and converting leads

Setting up the referral tool on Subbly

How to setup affiliate tracking through Subbly?

Adding conversion tracking to the checkouts

Analytics FAQ

Setting up Addons Upsell

AI Addon Bundle

Integrations & App Store

App store

Setting up Chartmogul

How to use other shipping services with Subbly?

Setting up Facebook CAPI & Pixel

Setting up Google Tag Manager

Setting up Google Analytics

Setting up ManyChat integration

Setting up Taxjar

Setting up Facebook Login

Setting up Google Auth

Setting up Mailchimp integration

Setting up Drip

Setting up HotJar integration

Setting up Flodesk (through Zapier)

Setting up Zendesk integration

Setting up Pirate Ship integration

Setting up Shipstation integration

How does the ShipStation integration work?

Setting up Bablic

Setting up Zapier

Setting up Klaviyo

Setting up Twilio integration

Setting up Intercom integration

Setting up SendGrid

Setting up Postmark

Setting up CartStack

How to edit checkout layout through Google Optimize?

Embed Subbly into external platform(s)

FAQs

FAQ about Subbly

What countries is Subbly available in?

How do I get help? (How to contact support)

What payment gateways are supported on Subbly?

Stripe vs. Paypal: Which one to use?

How much traffic can the Subbly servers handle?

Pricing plans, pricing structure and applicable transaction fees on Subbly

How and when do we charge VAT?

Does Subbly offer refunds?

Can I use Subbly for POS sales?

How can I migrate my customers from Stripe?

How can I migrate my customers from PayPal?

Does Subbly integrate with any accounting platform?

How to transfer domain between sites on Subbly?

Why doesn't Subbly have a marketplace?

Why my checkout redirects to a different product?

What shipping integrations do you provide?

When do I get paid?

Metafields and Tags

How can I access my previous receipts/invoices?

How can I send emails to my customers?

Working with Subbly Experts

Migrating to Subbly

- Subbly Help Center

- FAQs

- How and when do we charge VAT?

How and when do we charge VAT?

This article explains more closely how VAT is charged and for what customers on Subbly.

When do we charge VAT?

As of now, Subbly is charging an additional 20% VAT on top of the regular monthly/yearly invoice (transaction fees excluded!) if you are:

- located in the UK

- a non-business entity located in the European Union

If you're located in the EU and you have a business registered for VAT (tax), please make sure to provide the VAT number as explained below to avoid being charged for VAT on the Subbly invoice.

What is VAT and why are we collecting it?

VAT stands as an abbreviation for value-added tax. It's a type of tax that's levied on top of the product or service price in jurisdictions where companies are mandated by the tax government to collect taxes on the goods/services they sold.

United Kingdom imposes the collection of VAT. Given that Subbly is an entity registered in the UK, we are mandated to collect taxes for all transactions with UK-based entities (companies or individuals), as well as for businesses registered within the European Union.

How do we collect VAT?

Starting from the 1st of July, 2021, all transactions with the UK and EU-based non-business entities will have tax items added on top of the price of the invoice.

Taxes will be charged on top of the fixed subscription fee (the fixed price of the subscription paid monthly/annually).

How can you avoid being charged VAT?

If you're located in the UK, as per the governing UK tax laws, we are unfortunately mandated to charge 20% VAT regardless if you have a VAT number or not provided to your Subbly.

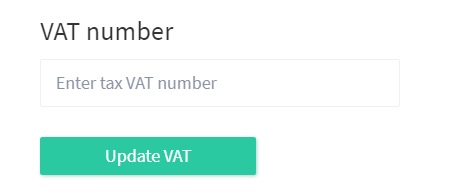

However, if your business is located in the EU and you do have a VAT number for it, please make sure to provide it by filling in the appropriate field on the Billing section of your Subbly admin as in the picture below:

If you have any questions about this, please let us know on chat.