Account & Billing

Can I switch between pricing plans? (on Subbly)

Setting up Stripe

Setting up PayPal

Setting up Braintree (or PayPal through Braintree)

Setting up Auth.net

Setting up Apple Pay & Google Pay?

Setting up a specific billing time

How to connect a domain to your website?

Handling invoices

How do I set the currency for my store?

Country of trade setting

Timezone setup

Taxes

How do I export taxes on Subbly?

Can I grant access to more users to my account? (Teams app)

Can I manage the email notifications I receive?

How do I put my Subbly store and website offline?

How do I cancel my trial?

How do I cancel my account?

Preventing Customer's Cancellations

Checkout & Payments

Setting up the checkouts and customer portal on custom domain

Testing checkouts and customer portal

Setting up your branding

How do I remove Subbly branding from the checkout?

How to translate the checkout and the customer portal?

How do I add Terms & Conditions to the checkout?

Do my customers need to register to make a purchase?

Checkout & cart widget behavior

Setting up cart widget

How to enable 3DS confirmation step at checkout?

Setting up multicurrency

How to change the position of the currency symbol at the checkout?

Why are my checkouts not working?

Updating cart widget based on webpage actions

Altering cart widget functions by embedding Subbly Javascript

Website Builder

AI Website Builder

Getting Started

Welcome to Subbly's agentic builder!

Pricing, Costs, and Credits Explained

A Quick Tour of the Agentic Builder Interface

Prompting for Success: How to Talk to the Agent

How to Create Your First Prompt

Your First Project: A Step-by-Step Guide

Core Features

Setting up Your Project Settings

How to Write Effective Project Instructions

Understanding the Different AI Models Available

Understanding the Element Selector Tool

Connecting Products to the Site

How to Set up a Custom Domain

Deploying Site

Troubleshooting

My Agent isn't Behaving as Expected: Common Issues and Fixes

Optimizing for Performance and Credit Usage

How to Revert to a Previous Version

When to Start a New Chat

Contacting Support

Cancelling Your AI Website Builder

Free Resource

How-To Video Guides

Connect product checkouts to elements

Build product page with pricing plan selection

How to add upsell to the checkout funnel

Create a survey flow with an add-on

Creating a bundle page

Build one-time shop with filtering and sorting facilities

Create a newsletter form with backend capture

Integrating map and store locator

Optimizing site's SEO

Create a blog

Changing the mobile layout vs. desktop layout

Legacy Builder

Dashboard apps

Articles App

Logo maker app

Designer Tools: Overview

Fonts App

Pages App

Designer Tools: Layout

Designer Tools: Typography

SEO App

Domain App

Languages App

Designer Tools: UI Kit

Templates App

Media App

Pop-Ups App

Getting started with Dashboard and Apps

Site Settings App

Edit mode

Troubleshooting ''there is an update'' error

How to change the title for your website?

How to add a cookie consent banner to your Subbly site?

How to create a banner on the website builder?

How to submit your website to Google, Yandex, Bing or Yahoo?

How to embed Instagram feed to my website?

How to create anchor points on your website?

How to set up event tracking codes on your website?

Adding chatbot to your Subbly site

Adding visual effects to your website

Building a page from scratch with Subbly

How to add images and videos to your website?

How to add GIFs to your website?

Configuring SSL for your website

Desktop vs. Mobile versions of a website

Positioning of elements

Why my domain was labeled as HREFLANG?

How to add Trust Pilot reviews to your website?

How to build your own product layout?

Setting up Headers and Footers across pages

Managing visibility settings of Elements and Blocks

How to create a Blog?

How do customers leave a review for my products?

Getting Started with the Website Builder

Basics of the Edit Mode

How to publish the latest changes on your website?

Previewing your Subbly website

Adding and creating Blocks on your website

How to localize your website (create a multilingual website)?

Colors tool

Why do the products go to 404 page?

How to create product category filter (Website builder)

Elements

Icons element

Blank space element

Language Switcher Element

Image Slider element

Form element

Map element

Product/Products Element

Breadcrumb element

Account Element

Accordion element

Button/Product Button element

Sharing Buttons element

Logo element

Quotes element

Paragraph element

Custom HTML element

Search element

Region Switcher element

Divider element

Articles and Article Categories element

Follow Us element

Gallery element

Title element

Video element

Image element

Countdown element

Pages element

Products

Product builder wizard

What are subscriptions?

Ad-hoc subscriptions

Anchored subscriptions

Understanding cut-off dates

Incoherent subscriptions

Implications of using Anchored + Incoherent

Setting subscriptions to auto-expire

Membership subscriptions

Content feed (How to use Subbly as a paywall?)

How to set sequential subscriptions in Subbly?

Seasonal subscriptions

How does the pre-order setting work?

How to set up pre-paid subscriptions?

Setting up commitment period for your products

Setting up trial period for subscription products

How to set up shipping methods for my store?

Setting up Mondial Relay

How gifting works?

How to use gift vouchers?

How to create one-time products?

Using one time products as bundles

How do I edit my product price and billing settings?

Can I set my subscriptions to auto-cancel themselves?

How to create "Subscribe & Save" offers on Subbly?

How to unpublish a product?

Setting up funnels

Subscription add-ons

Fixed bundles

Customizable bundles

Subscribe and Save bundles

Setting up subscription products

Survey builder

Customers

How customers manage their subscription? (Customer portal)

Can I add customer's subscriptions manually?

Customer's Labels Explanation

How to switch the subscription product customer is subscribed to?

How to change renewal date for a customer?

How can I see my customers' preferences?

How to change the shipping address for a customer?

How customers change their password?

Can customers add products to their subscription?

How to process a refund for the customer?

How to reactivate customer's subscription

How does skipping/pausing work?

Handling customer email notifications through Subbly (Templated emails)

Account credit balance

How do I export my customer data from Subbly?

Why my customer wasn't charged?

How to cancel customer's subscription?

Event Logs

AI Author Bot (powered by AI)

Orders

Order Labels Explained

Handling Orders

How to filter orders?

Importing Orders

Can I create a test order?

How to create adhoc orders/charges?

How to add a tracking number for customer's order?

Why am I not seeing my orders?

Why my orders don't appear in my Shipstation admin?

Growth & Retention

Customer retention

How dunning tool works on Subbly?

Cancellation Offers (Cancellation Flow)

Cancellation Analytics

Churn Insights

Payment Failure Email

Upcoming Renewal Email

Predictive churn (powered by AI)

Growth tools

Automations FAQ

Automations recipes (use cases)

Coupons

Inventory Management

Handling out of stock

Using cart abandonment tool

Setting up lead forms and converting leads

Setting up the referral tool on Subbly

How to setup affiliate tracking through Subbly?

Adding conversion tracking to the checkouts

Analytics FAQ

Setting up Addons Upsell

AI Addon Bundle

Integrations & App Store

App store

Setting up Chartmogul

How to use other shipping services with Subbly?

Setting up Facebook CAPI & Pixel

Setting up Google Tag Manager

Setting up Google Analytics

Setting up ManyChat integration

Setting up Taxjar

Setting up Facebook Login

Setting up Google Auth

Setting up Mailchimp integration

Setting up Drip

Setting up HotJar integration

Setting up Flodesk (through Zapier)

Setting up Zendesk integration

Setting up Pirate Ship integration

Setting up Shipstation integration

How does the ShipStation integration work?

Setting up Bablic

Setting up Zapier

Setting up Klaviyo

Setting up Twilio integration

Setting up Intercom integration

Setting up SendGrid

Setting up Postmark

Setting up CartStack

How to edit checkout layout through Google Optimize?

Embed Subbly into external platform(s)

FAQs

FAQ about Subbly

What countries is Subbly available in?

How do I get help? (How to contact support)

What payment gateways are supported on Subbly?

Stripe vs. Paypal: Which one to use?

How much traffic can the Subbly servers handle?

Pricing plans, pricing structure and applicable transaction fees on Subbly

How and when do we charge VAT?

Does Subbly offer refunds?

Can I use Subbly for POS sales?

How can I migrate my customers from Stripe?

How can I migrate my customers from PayPal?

Does Subbly integrate with any accounting platform?

How to transfer domain between sites on Subbly?

Why doesn't Subbly have a marketplace?

Why my checkout redirects to a different product?

What shipping integrations do you provide?

When do I get paid?

Metafields and Tags

How can I access my previous receipts/invoices?

How can I send emails to my customers?

Working with Subbly Experts

Migrating to Subbly

- Subbly Help Center

- Growth & Retention

- Growth tools

- Analytics FAQ

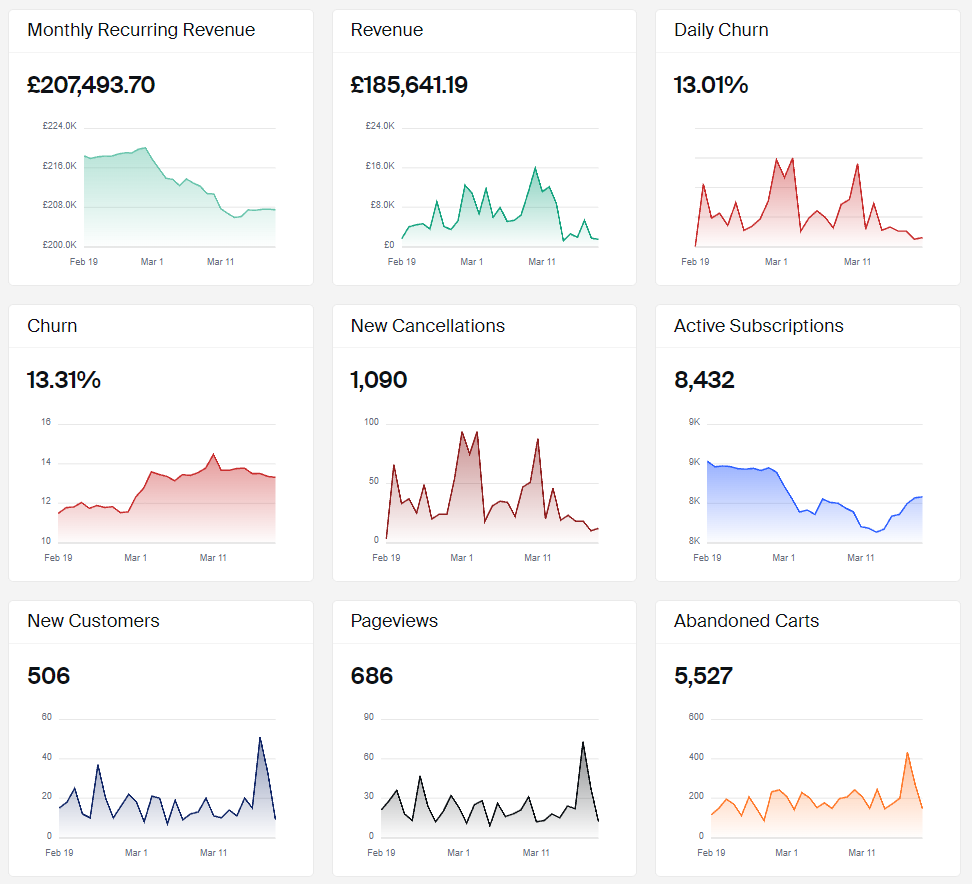

Analytics FAQ

Knowing your metrics is very important. With our Analytics you are able to gain insight on some important stats that will help you forecast your sales or give you ideas on the improvement areas that you'll need to work on. Please review this article for a more detailed information on how we're calculating each one of these stats.

Monthly Recurring Revenue (MRR)

Best possible way of understanding this one is by showing a simple example. Let's say that you have 10 customers each paying $10/mo on a recurring basis. MRR will than be:

10 x $10 = $100

Revenue

Revenue metric is calculated as:

Sum of orders total for the date/date range - sum of refunded amount for the selected date/date range

Churn

Churn Analytics include by default the early churn that, like shown below, will help you get more accurate calculations to have a clear reading on what to improve.

Formula used:

SUM((Number of active subscribers at the start of the day) - (Number of active subscribers at the end of the day) / (Number of active customers at the start of the day))

Note that new customer gained that day are excluded from the calculation, as well as customers who churn and then reactivate on the same day.

If we wanted to see the churn rate for the period of Monday - Tuesday, we would do this calculation:

Monday: (100 - 95) / 100 x 100 = 5%

Tuesday: (95-90) / 95 x 100 = 5.26%

SUM(Monday churn rate + Tuesday churn rate) = 10.26% customer churn rate

Accumulative Churn

This one can be enabled by turning on the toggle on top of the churn graphic and doesn't take into account the early churn:

It is calculated as follows:

(Sum of cancelled subscriptions in the last 30 days / How much active subscriptions were active on the store 30 days ago) x 100

New Cancellations

Simple sum of all cancelled subscriptions on the selected date/date range.

Active Subscriptions

Sum of all active subscriptions on the selected date/date range.

New Customers

Count of all new customers (both subscription and one times taken into account here!) within the selected time period (number of customers at the end of the time frame - number of customers at the beginning of the selected time frame).

Pageviews

Number of pageviews within the selected time period.

Abandoned Carts

Count of all carts that were abandoned and were not revisited within the certain date range.

New Subscriptions

Count of all new subscriptions within the selected time period (number of active subscriptions at the end of the time frame - number of active subscriptions at the beginning of the selected time frame).

Lifetime Value of Customer (LTV)

LTV is a very important metric that is used for projecting the growth of the business based on average MRR and average churn. Put in simple words, LTV actually shows how much money a customer is going to give to your business before he/she ultimately unsubscribes and churn.

As the LTV is affected by churn metrics, you'll also see the changes explained in the churn section above.

Formula would be:

Average MRR per customer / Average Churn

Formula with the early churn analytics (not accumulative):

Average MRR per customer / Average Churn (using the updated formula explained above)

Both average MRR and churn are calculated in regards to the selected time period and based on the calculations presented above in the article

Based on this, LTV can be boosted by either increasing the MRR per customer/user or by reducing churn of your business.

FAQ

How do you calculate churn on the customers who are skipping the payment?

These are not taken into consideration when calculating churn .