Account & Billing

Can I switch between pricing plans? (on Subbly)

Setting up Stripe

Setting up PayPal

Setting up Braintree (or PayPal through Braintree)

Setting up Auth.net

Setting up Apple Pay & Google Pay?

Setting up a specific billing time

How to connect a domain to your website?

Handling invoices

How do I set the currency for my store?

Country of trade setting

Timezone setup

Taxes

How do I export taxes on Subbly?

Can I grant access to more users to my account? (Teams app)

Can I manage the email notifications I receive?

How do I put my Subbly store and website offline?

How do I cancel my trial?

How do I cancel my account?

Preventing Customer's Cancellations

Checkout & Payments

Setting up the checkouts and customer portal on custom domain

Testing checkouts and customer portal

Setting up your branding

How do I remove Subbly branding from the checkout?

How to translate the checkout and the customer portal?

How do I add Terms & Conditions to the checkout?

Do my customers need to register to make a purchase?

Checkout & cart widget behavior

Setting up cart widget

How to enable 3DS confirmation step at checkout?

Setting up multicurrency

How to change the position of the currency symbol at the checkout?

Why are my checkouts not working?

Updating cart widget based on webpage actions

Altering cart widget functions by embedding Subbly Javascript

Website Builder

AI Website Builder

Getting Started

Welcome to Subbly's agentic builder!

Pricing, Costs, and Credits Explained

A Quick Tour of the Agentic Builder Interface

Prompting for Success: How to Talk to the Agent

How to Create Your First Prompt

Your First Project: A Step-by-Step Guide

Core Features

Setting up Your Project Settings

How to Write Effective Project Instructions

Understanding the Different AI Models Available

Understanding the Element Selector Tool

Connecting Products to the Site

How to Set up a Custom Domain

Deploying Site

Troubleshooting

My Agent isn't Behaving as Expected: Common Issues and Fixes

Optimizing for Performance and Credit Usage

How to Revert to a Previous Version

When to Start a New Chat

Contacting Support

Cancelling Your AI Website Builder

Free Resource

How-To Video Guides

Connect product checkouts to elements

Build product page with pricing plan selection

How to add upsell to the checkout funnel

Create a survey flow with an add-on

Creating a bundle page

Build one-time shop with filtering and sorting facilities

Create a newsletter form with backend capture

Integrating map and store locator

Optimizing site's SEO

Create a blog

Changing the mobile layout vs. desktop layout

Legacy Builder

Dashboard apps

Articles App

Logo maker app

Designer Tools: Overview

Fonts App

Pages App

Designer Tools: Layout

Designer Tools: Typography

SEO App

Domain App

Languages App

Designer Tools: UI Kit

Templates App

Media App

Pop-Ups App

Getting started with Dashboard and Apps

Site Settings App

Edit mode

Troubleshooting ''there is an update'' error

How to change the title for your website?

How to add a cookie consent banner to your Subbly site?

How to create a banner on the website builder?

How to submit your website to Google, Yandex, Bing or Yahoo?

How to embed Instagram feed to my website?

How to create anchor points on your website?

How to set up event tracking codes on your website?

Adding chatbot to your Subbly site

Adding visual effects to your website

Building a page from scratch with Subbly

How to add images and videos to your website?

How to add GIFs to your website?

Configuring SSL for your website

Desktop vs. Mobile versions of a website

Positioning of elements

Why my domain was labeled as HREFLANG?

How to add Trust Pilot reviews to your website?

How to build your own product layout?

Setting up Headers and Footers across pages

Managing visibility settings of Elements and Blocks

How to create a Blog?

How do customers leave a review for my products?

Getting Started with the Website Builder

Basics of the Edit Mode

How to publish the latest changes on your website?

Previewing your Subbly website

Adding and creating Blocks on your website

How to localize your website (create a multilingual website)?

Colors tool

Why do the products go to 404 page?

How to create product category filter (Website builder)

Elements

Icons element

Blank space element

Language Switcher Element

Image Slider element

Form element

Map element

Product/Products Element

Breadcrumb element

Account Element

Accordion element

Button/Product Button element

Sharing Buttons element

Logo element

Quotes element

Paragraph element

Custom HTML element

Search element

Region Switcher element

Divider element

Articles and Article Categories element

Follow Us element

Gallery element

Title element

Video element

Image element

Countdown element

Pages element

Products

Product builder wizard

What are subscriptions?

Ad-hoc subscriptions

Anchored subscriptions

Understanding cut-off dates

Incoherent subscriptions

Implications of using Anchored + Incoherent

Setting subscriptions to auto-expire

Membership subscriptions

Content feed (How to use Subbly as a paywall?)

How to set sequential subscriptions in Subbly?

Seasonal subscriptions

How does the pre-order setting work?

How to set up pre-paid subscriptions?

Setting up commitment period for your products

Setting up trial period for subscription products

How to set up shipping methods for my store?

Setting up Mondial Relay

How gifting works?

How to use gift vouchers?

How to create one-time products?

Using one time products as bundles

How do I edit my product price and billing settings?

Can I set my subscriptions to auto-cancel themselves?

How to create "Subscribe & Save" offers on Subbly?

How to unpublish a product?

Setting up funnels

Subscription add-ons

Fixed bundles

Customizable bundles

Subscribe and Save bundles

Setting up subscription products

Survey builder

Customers

How customers manage their subscription? (Customer portal)

Can I add customer's subscriptions manually?

Customer's Labels Explanation

How to switch the subscription product customer is subscribed to?

How to change renewal date for a customer?

How can I see my customers' preferences?

How to change the shipping address for a customer?

How customers change their password?

Can customers add products to their subscription?

How to process a refund for the customer?

How to reactivate customer's subscription

How does skipping/pausing work?

Handling customer email notifications through Subbly (Templated emails)

Account credit balance

How do I export my customer data from Subbly?

Why my customer wasn't charged?

How to cancel customer's subscription?

Event Logs

AI Author Bot (powered by AI)

Orders

Order Labels Explained

Handling Orders

How to filter orders?

Importing Orders

Can I create a test order?

How to create adhoc orders/charges?

How to add a tracking number for customer's order?

Why am I not seeing my orders?

Why my orders don't appear in my Shipstation admin?

Growth & Retention

Customer retention

How dunning tool works on Subbly?

Cancellation Offers (Cancellation Flow)

Cancellation Analytics

Churn Insights

Payment Failure Email

Upcoming Renewal Email

Predictive churn (powered by AI)

Growth tools

Automations FAQ

Automations recipes (use cases)

Coupons

Inventory Management

Handling out of stock

Using cart abandonment tool

Setting up lead forms and converting leads

Setting up the referral tool on Subbly

How to setup affiliate tracking through Subbly?

Adding conversion tracking to the checkouts

Analytics FAQ

Setting up Addons Upsell

AI Addon Bundle

Integrations & App Store

App store

Setting up Chartmogul

How to use other shipping services with Subbly?

Setting up Facebook CAPI & Pixel

Setting up Google Tag Manager

Setting up Google Analytics

Setting up ManyChat integration

Setting up Taxjar

Setting up Facebook Login

Setting up Google Auth

Setting up Mailchimp integration

Setting up Drip

Setting up HotJar integration

Setting up Flodesk (through Zapier)

Setting up Zendesk integration

Setting up Pirate Ship integration

Setting up Shipstation integration

How does the ShipStation integration work?

Setting up Bablic

Setting up Zapier

Setting up Klaviyo

Setting up Twilio integration

Setting up Intercom integration

Setting up SendGrid

Setting up Postmark

Setting up CartStack

How to edit checkout layout through Google Optimize?

Embed Subbly into external platform(s)

FAQs

FAQ about Subbly

What countries is Subbly available in?

How do I get help? (How to contact support)

What payment gateways are supported on Subbly?

Stripe vs. Paypal: Which one to use?

How much traffic can the Subbly servers handle?

Pricing plans, pricing structure and applicable transaction fees on Subbly

How and when do we charge VAT?

Does Subbly offer refunds?

Can I use Subbly for POS sales?

How can I migrate my customers from Stripe?

How can I migrate my customers from PayPal?

Does Subbly integrate with any accounting platform?

How to transfer domain between sites on Subbly?

Why doesn't Subbly have a marketplace?

Why my checkout redirects to a different product?

What shipping integrations do you provide?

When do I get paid?

Metafields and Tags

How can I access my previous receipts/invoices?

How can I send emails to my customers?

Working with Subbly Experts

Migrating to Subbly

Taxes

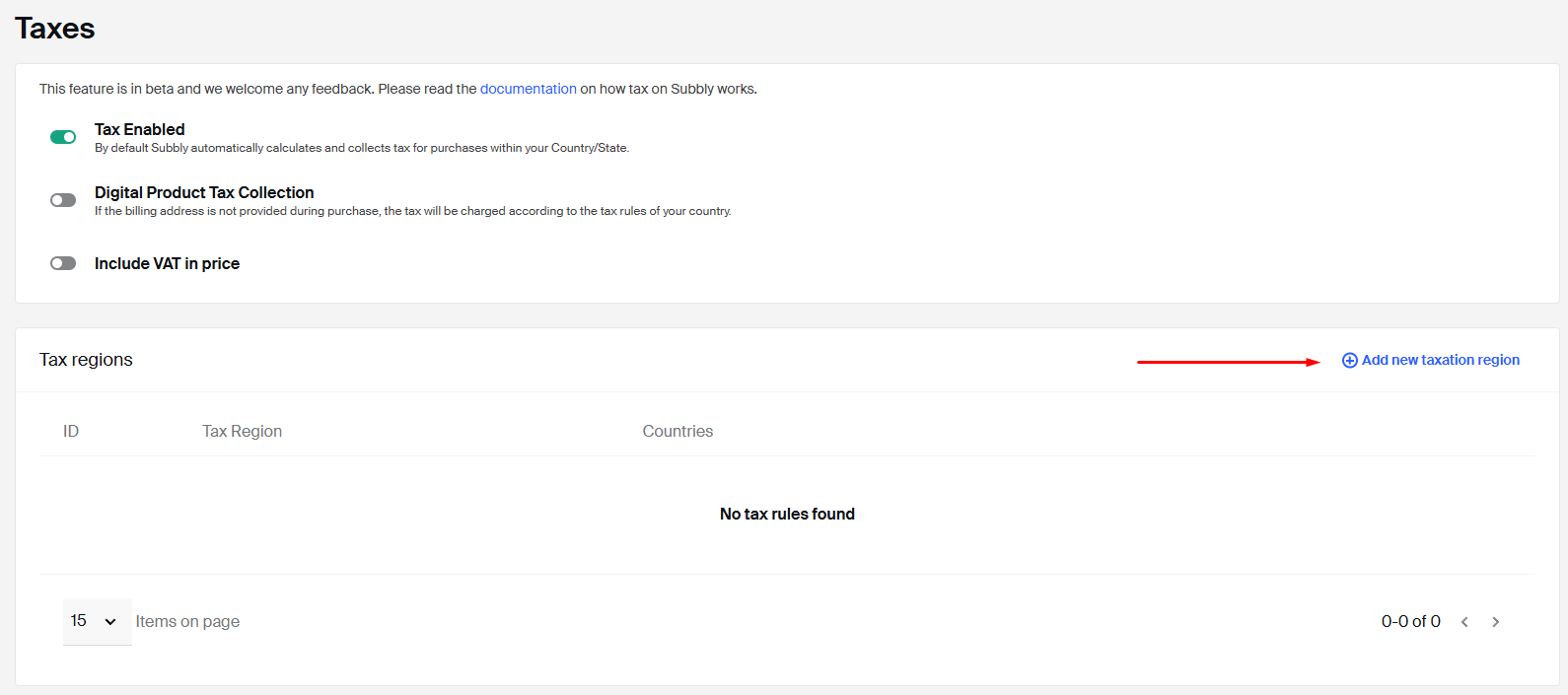

Enabling tax calculations on your checkouts was never easier. Keep reading to learn how it works for your store!

How it works?

Managing taxes correctly is essential for staying compliant and avoiding unnecessary penalties. That’s why Subbly offers three flexible solutions to help you handle sales tax effectively based on your business needs and location:

- Built-in Subbly tax calculator

- Integration with TaxJar

- Manual setup of tax regions

Getting started is easy. Simply enable tax settings for your store directly from your Subbly admin panel, and we'll automatically take care of calculating the appropriate taxes at checkout based on your business address and your customer’s location—using sales tax nexus rules.

Sales tax nexus refers to the connection between a business and a state or local jurisdiction that obligates the business to collect and remit sales tax on sales made to customers in that area. In practice, this means that if your customer is located in a region where you have a registered tax nexus, Subbly will automatically calculate and apply the correct tax rate at checkout.

Want more control? You can also define your own custom tax regions using Subbly’s Tax Region feature, giving you the flexibility to tailor tax rules based on where you operate.

Since Subbly handles tax logic based on both merchant and customer locations, it’s important to ensure that your business address is correctly set on your account page, and that customers provide accurate country and state information during checkout.

This guide will walk you through each of the three available solutions, when to use them, and how to configure them to stay compliant and run your business smoothly.

Built-in Subbly tax calculator

VAT included in the price or VAT on top of the price? Which one should I use?

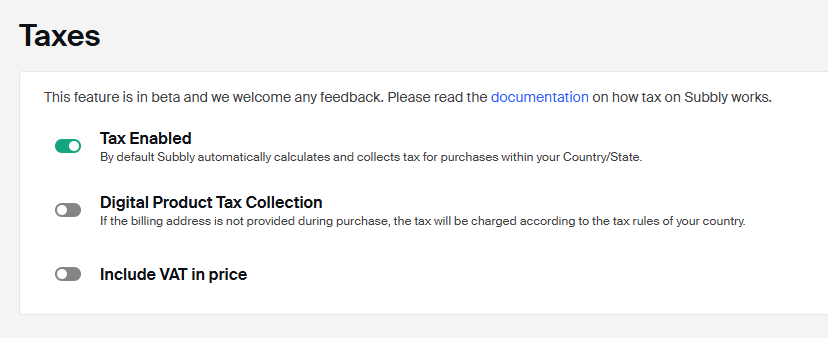

Just below the Tax Enabled toggle in your Admin, there's an additional option to Include VAT in price:

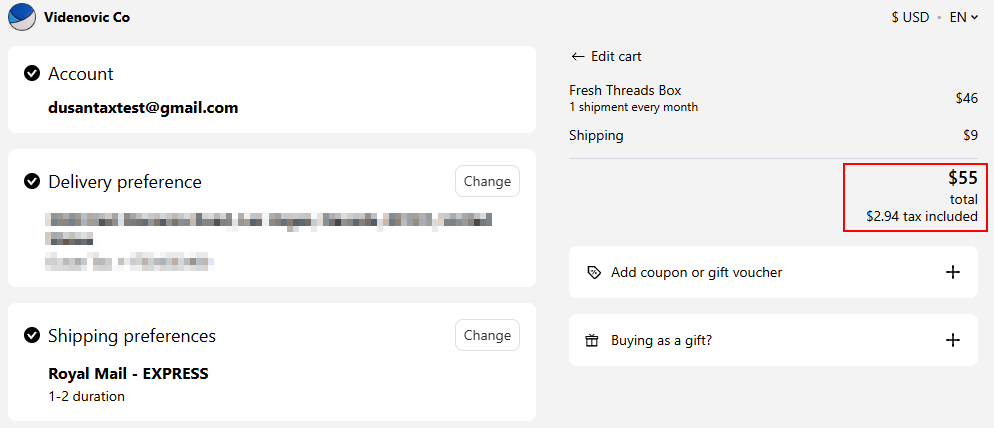

Choosing VAT in price means your product price already includes the tax amount, so when calculating taxes, the total to be paid will not increase for your customers:

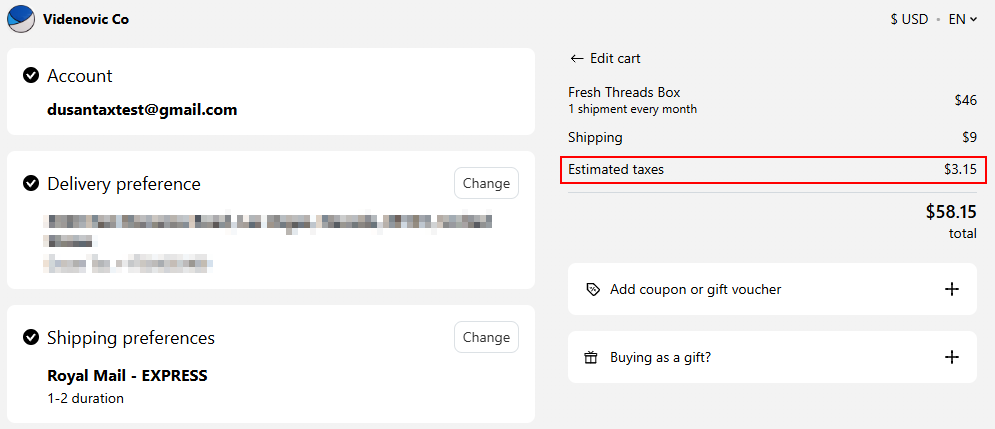

On the other hand, if you do want to charge VAT on top of the product price, then you must keep the Include VAT in price toggle disabled so the tool calculates taxes in addition to the price set for the product:

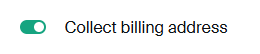

The Digital Product Tax Collection option works for digital/membership subscription products where the shipping address is not required at the checkout, however, for the tax to be calculated, make sure that you are enabling the "Collect billing address" toggle in the Settings > Advanced section:

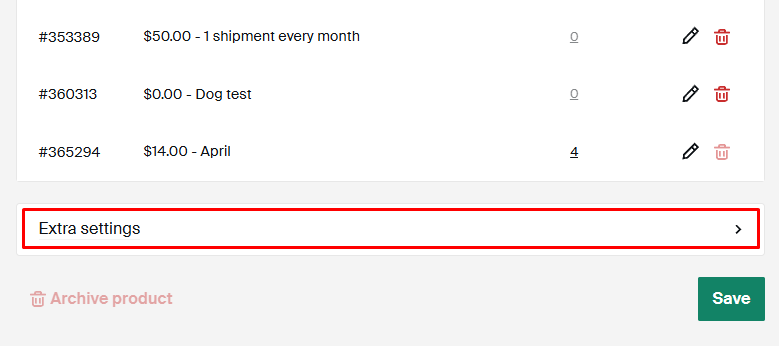

Also, enabling the option to collect the "Shipping address" for the digital type of a subscription product in the Extra Settings on the product creation page:

Will enabling a tax calculator affect my current customers?

If you choose to enable the tax settings when you already have active subscribers, this will affect your existing customers as well for the future payments.

How to export taxes collected?

You are able to export all your transactions at any point from here within your admin. Refer to this article for further information.

TaxJar integration

Only if you need a more comprehensive way of calculating taxes because:

- of the type of goods you sell

- you have a significant presence or sales tax nexus in more than one state or country

- or simply because you want more advanced functionalities

Then you should consider using our TaxJar integration instead of our built-in calculator as the former will better adapt to your business taxation requirements. You can see how to set up the TaxJar app here.

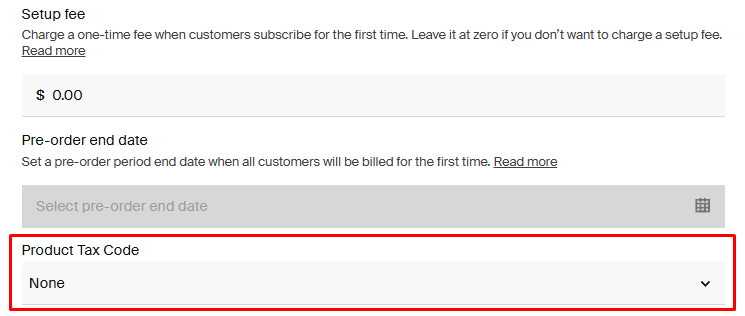

Passing product tax code to Taxjar

If you're based in the US and you need to be able to pass specific product tax codes over to Taxjar for more precise tax calculation, don't forget that you can choose the product tax type from inside the product creation widget under Extra settings as seen down below:

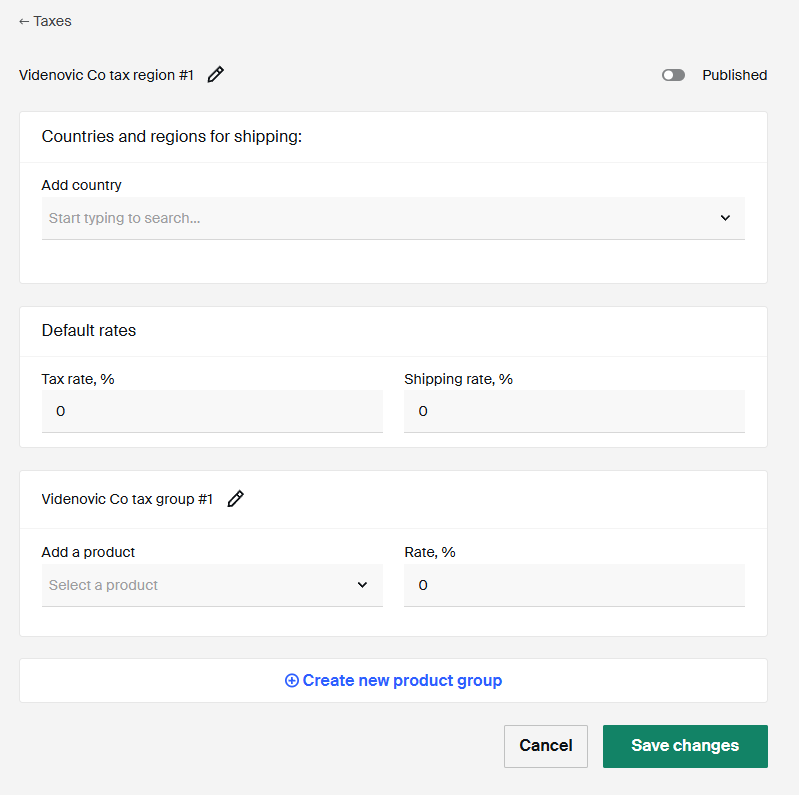

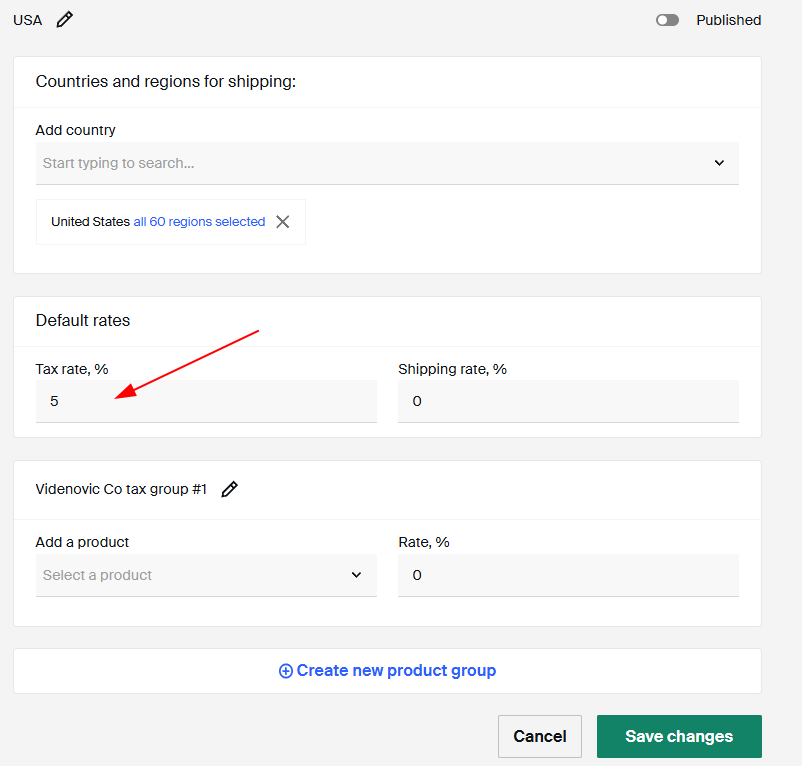

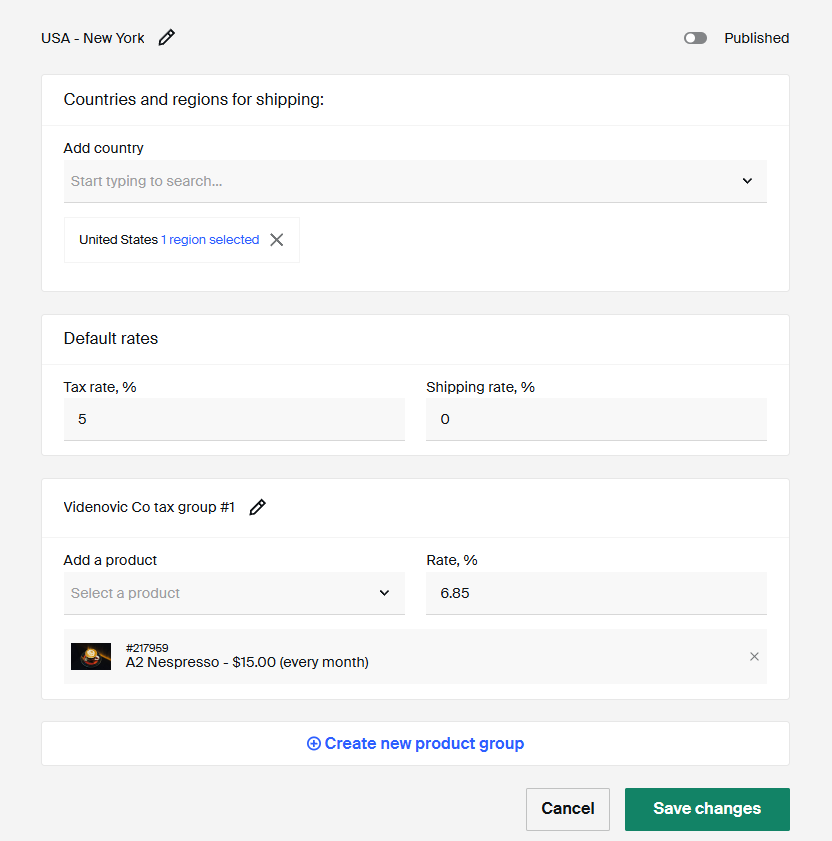

Setting up tax regions

It is now possible to create your own tax rates for your store and add separate tax rates for each state in the USA or globally.

The tax rate consists of 3 different options for taxing:

- Default tax rate

- Shipping tax rate

- Product group tax rate

You can create a default tax rate for all states in the USA like in this example here:

Or even create a tax rate for only one state and only one product:

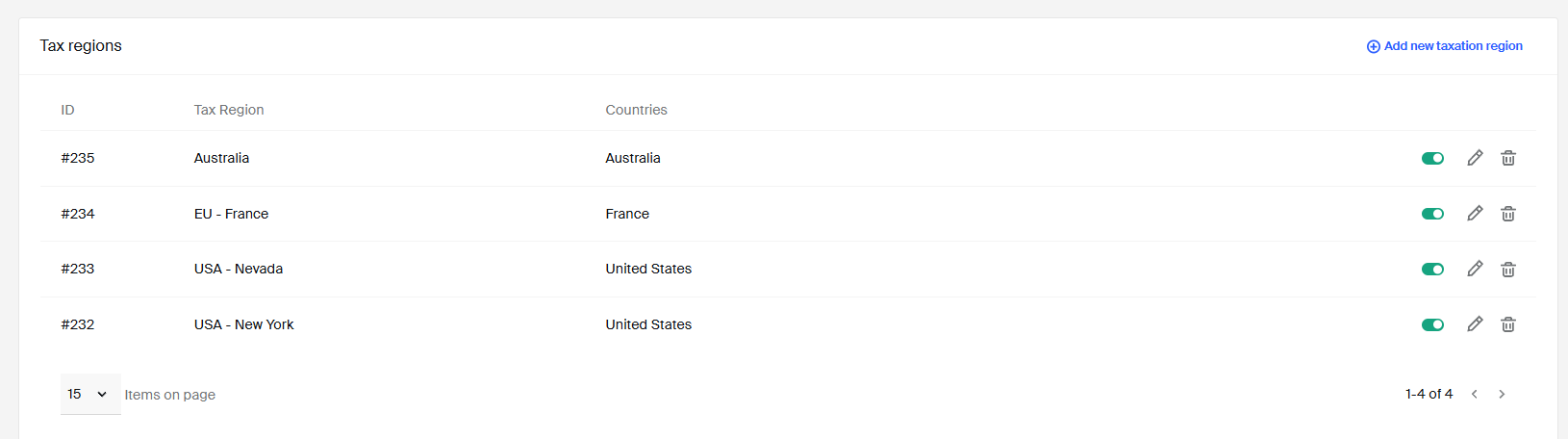

You can have an unlimited number of tax regions, and publish them or unpublish them as per your needs:

Important considerations

Here are key things to keep in mind when configuring taxes on Subbly:

- TaxJar Pricing: Using TaxJar involves additional costs, starting from a base plan and increasing your transaction volume. Check TaxJar's pricing for details.

- Digital Product Tax: Digital goods often have different tax rules depending on the location. If using TaxJar, assign the correct product tax code to ensure accurate handling.

- Product Tax Codes: TaxJar relies on product tax codes for categorization. Failing to assign the right code may lead to incorrect tax collection.

- Business Address Matters: Your business address must be located in the country where you’re trading. Otherwise, taxes may not calculate correctly during checkout. However, that is why we introduced Tax Regions where you can add your own tax rules inside Subbly Admin.

- Tax at Checkout:

- Taxes can be displayed as included in product prices or added at checkout.

- Example: A product priced at $20 with 10% VAT can either display as $20 (VAT included) or show $20 + $2 tax at checkout.

You can toggle VAT-inclusive pricing from Settings > Taxes, depending on how you want your pricing to appear to customers.

By choosing the right tax setup for your business, you can ensure compliance and simplify the buying experience for your customers. If you're unsure which method to choose, start with the built-in calculator and scale up with TaxJar or manual regions as your business grows.